Last spring, Gov. Jack Markell celebrated news that more than a million active legal entities were then incorporated in Delaware, a state with fewer than 900,000 residents. It was the latest in a long string of First State boasts of its business friendliness.

More than half of U.S. publicly-traded companies and fully 64 percent of the Fortune 500 were among that number, according to the state’s Division of Corporations. In 2012, more than 90 percent of IPOs were from Delaware legal entities, including Facebook and Yelp. That same year, the tiny 1209 North Orange Street in Wilmington was the legal home to 285,000 businesses.

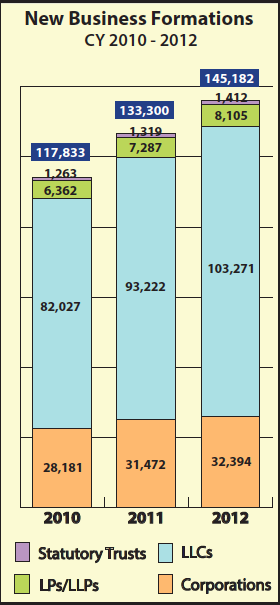

During that time, the state saw more than 10 percent growth in the year-over-year formation of LLCs, the incorporation of choice for many of today’s young, early stage tech firms.

https://www.youtube.com/watch?v=uYx4hq_Heeg&feature=emb_title

Here’s why:

- Legal framework — The Delaware General Corporation Law is said to be among the most flexible for business creation and protection. Among other perfectly legal advantages is that taxable income earned elsewhere can be made into tax-exempt income (no out-of-state corporate tax) in Delaware, thereby drastically reducing a company’s tax bill. That’s the so-called “Delaware loophole” that has Pennsylvania Democratic gubernatorial candidate Tom Wolf (among others) rallying for a legislative change.

- Judiciary specialization — The Delaware Court of Chancery was established in 1792 and has remained relatively speedy and inexpensive for resolving disputes for Delaware corporations with trials by judge, not jury. It’s the national standard. That head start has given an enormous body of Delaware case law that further maintains it as a favored place for corporate law.

- State prioritization — Business incorporation fees represent the state’s second largest revenue source behind income tax. Since it has been a state focus for so long, Delaware state government and its Division of Corporations prioritize business formation and support, Markell and others frequently say. Its legislators have remained mindful of maintaining its modern tax law — like last year’s legislation around public benefit corporations.

Among those flexible and pro-business statutes are the rules that allow the corporation to be operated anywhere in the world, provided there is a Delaware registered agent — someone to represent the firm locally. Delaware businesses also benefit from there being no state sales tax, nor state corporate tax for those firms that operate out of the state — including big brands like Apple and Coca-Cola.

Delaware remains the standard, but others, like Connecticut, are in hot pursuit. With leadership comes criticism. What is a boon for Delaware is often argued as costing other states billions of dollars in lost tax revenue.

It also prompts that secondary challenge: If so many businesses are legally incorporated in Delaware strictly for the tax benefits, how many are based here because they give a damn about Delaware?