Imagine being able to hold your money in a bank account with multiple currencies. Eight, to be exact. Imagine the currency conversion process being as easy as transferring money from one bank account to another. That’s what Zenbanx wants to do.

“We want to turn sending money into a conversation,” said Steve Payne, director of software development at Zenbanx.

While Zenbanx itself is not an actual bank, it partners with banks that have a presence in countries that use a currency the company wishes to provide to its users. For example on the homefront, the company has a partnership with WSFS Bank for its dollar-related operations. It also has partners in India.

Last year, we told you about the arrival of Zenbanx. Well now, you get to finally see how it works.

Here’s what you can expect to see: You create a Zenbanx account with your information, you pick a “primary currency” according to where you do the most business. A little nervous? Don’t be, it’s FDIC insured. You link the app with your Facebook, Twitter, Siri and sending and receiving money can be as easy as having a conversation.

Payne expects the app to be most popular with international students and those who often travel to multiple countries on business.

He describes the technology as “reducing the friction between the rails,” with rails being the different digital routes on which money can be transported electronically. The idea is negotiate the lowest conversion rates possible for Zenbanx customers.

Curious about how it works? Make sure you stop by the demo pit at Tech2gether at Delaware Innovation Week because you won’t be able to download it for yourself just yet.

“Right now it’s only available to employees,” Payne said. “We’re piloting it internally to make sure the customer experience is optimized accordingly. We’re primarily showcasing technology for now and using employees as beta testers. We do that quite often.”

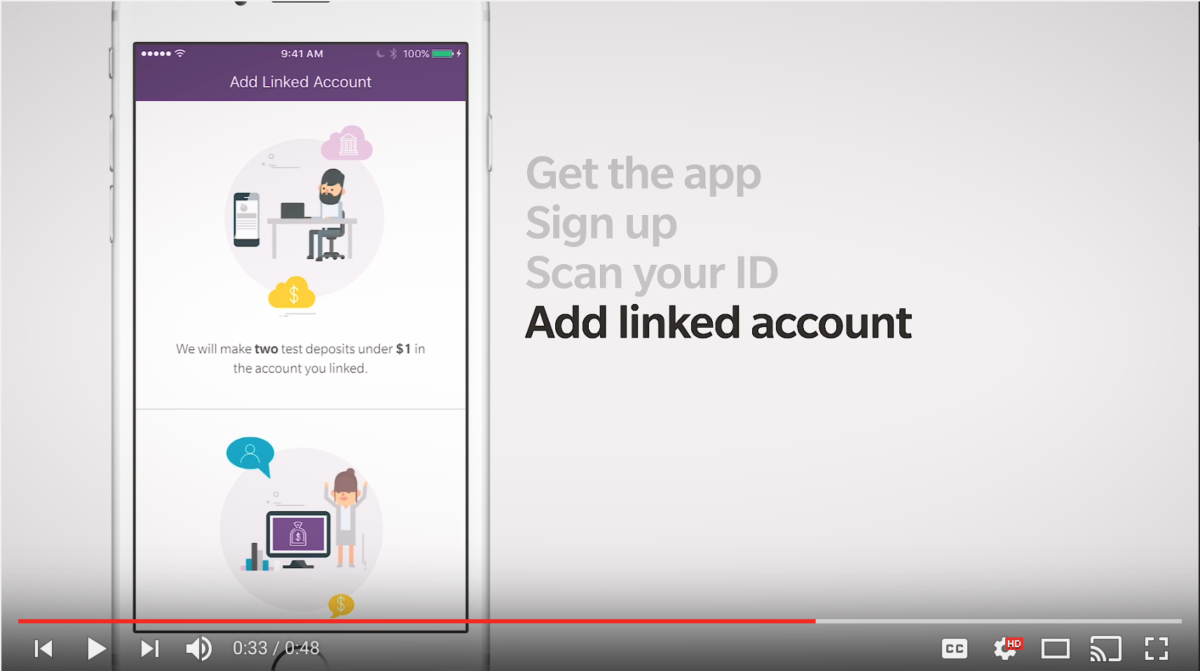

Here’s a video about the company’s vision:

https://www.youtube.com/watch?v=cQA68pABzGs

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

Delaware students take a field trip to China using their tablets and ChatGPT

From rejection to innovation: How I built a tool to beat AI hiring algorithms at their own game