This essay was originally published via ImpactPHL Perspectives, a multi-part series which explores the many facets of the impact economy in Greater Philadelphia from the perspectives of its doers, movers, shakers and agents of change. This version has been edited for style.

Impact investing has existed for a century but it has not been fully embraced by the investment community and, to many, is still not considered a mainstream investment practice.

While there are signs that its adoption is increasing, there are several barriers, both real and perceived, that have slowed its adoption.

Below is an explainer on some of the key reasons for impact investments’ slow adoption, with background on the industry and specific factors causing its slow adoption, as well as several principles aimed at furthering investors’ understanding of impact.

Impact investing background

Impact investing has been present in the United States for more than 100 years, beginning with the Quakers Friends Fiduciary Corporation eliminating investments in weapons, alcohol and tobacco in 1898. (Quakers pioneered social enterprise, too.)

Since then, the concept of using investment dollars to trigger change has progressed, with notable examples as the enforcement of the Sullivan principles in the 1970s, the creation of the MSCI KDD 400 Social Index in the 1990s and the recent adoption of several key agreements, such as the Addis Ababa Action Agenda, the Paris Climate Agreement, and the 2030 Sustainable Development Goals (SDGs). Each of these initiatives has made or is making significant changes to our global society.

The Global Impact Investment Network recently estimated that the size of the impact investment market is over $500 billion.

The Global Impact Investment Network (GIIN) recently estimated that the size of the impact investment market is over $500 billion, which pales in the context of over $65 trillion in institutional assets. However, it also estimates that slightly over 800 asset managers account for about 50% of industry assets under management, while 31 development finance institutions (DFIs) manage just over a quarter of total industry assets.

This implies that impact investing still has not been widely adopted by investing organizations and that many of the organizations which have embraced impact are relatively small. While many stakeholders are continuing to promote impact investing within their organizations and most observers expect impact investing to grow, we recognize three factors that are slowing the rate of growth.

Factor 1: Lack of understanding

Much of the confusion about impact investing stems from its inherent subjectivity which creates a lack of understanding. The inability to adopt a common impact investment language and market standards continues to exasperate this problem.

The terms ESG, SRI, MRI, SDG, PRI, double/triple-bottom-line, etc. are all bandied about in a way that is meaningless to most. An absence of a common impact investment language has left many of the professional advisors that institutional asset owners rely upon without a full understanding of this space.

As illustrated by the below chart, the spectrum of impact investing is a dynamic one, but not always clearly defined.

[Editor’s note: This chart is the clearest explainer of terms I’ve seen, and I edited a social impact news site for three years.]

(Image courtesy of ImpactPHL)

Additionally, impact investment information often lacks the form and data that an institutional asset owner is accustomed to seeing when evaluating the risk/return profiles of investment opportunities. This lack of impact investment knowledge and data has led, up until recently, to limited learning, innovation and experimentation.

Factor 2: Understanding fiduciary responsibility

An important consideration for institutional investors is their fiduciary duty. Many institutional investors still do not fully understand their regulatory responsibilities as fiduciaries as it pertains to impact investing. What is clear is a fiduciary’s primary duty is to act in the best interest of a plan’s beneficiaries which means that they must consider all financially material factors, regardless of their origin.

Complicating matters further, trustees of different types of plans are subject to different regulatory rules. For example, the fiduciaries of trust and estate funds must follow a Uniform Trust Code while pension plans are governed by the Department of Labor (DOL). What makes this more confusing is the DOL has issued many, sometimes conflicting, guidance regarding how to weigh an investment’s potential impact against its financial return.

The one thing that remains clear from the last 25 years of DOL written interpretations is a prudent investment that also contains Collateral Benefits (Impact) is not in question of breaching the fiduciary rules under the Employee Retirement Income Security Act.

Factor 3: Traditional investment theory

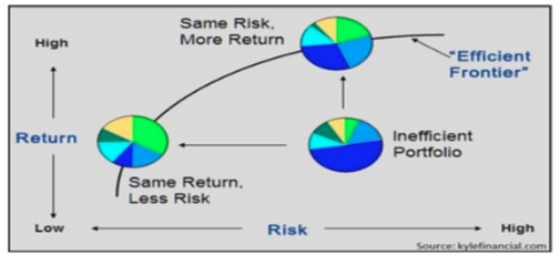

The investment vehicles that the financial services industry creates are conveyed in traditional investment terms that both asset owners and their investment professionals recognize and can readily use in building their overall portfolios. For example, investment professionals generally work to create an investment portfolio that seeks to maximize returns at a given level of risk using Modern Portfolio Theory (MPT), the work of 1952 Nobel Laureate Harry Markowitz.

MPT is built on the premise that risk is an inherent part of higher reward. As illustrated in the chart above, the relationship between risk and return, as assumed by MPT, uses volatility as the measure of risk. According to this theory, it is possible to construct an “efficient frontier” of optimal portfolios offering the maximum possible expected return for a given level of risk. MPT assumes that an investor will take on more risk only if the investor is expecting more reward.

However, MPT does not weigh the collateral benefits (impact) of an investment, but it is focused purely on maximizing the financial return at a given level of risk. This has left many to believe, we will argue incorrectly, that incorporating impact into an investment will be a cost or added risk to that investment’s financial return.

Understanding impact

In viewing these hurdles, it becomes clear that to achieve a wider adoption of impact investing, investors will need a better understanding of how impact fits into the larger investment universe. This understanding will provide investors with the knowledge, legal cover and evaluation framework needed to make impact investments.

To assist investors in gaining this understanding, we have developed the four principles below:

1. An investment has an impact return and risk in the same way that it has a financial return and risk.

Just as an impact investment has a financial risk/return profile (i.e., the distribution of potential financial gain or loss that can reasonably be expected from an investment), there may be a range in the possible impact delivered from an investment as well (i.e., there is also risk in impact and it may not reach investor expectations).

Investors typically look at the financial return at a given level of financial risk. However, the impact of an investment is variable as well and there is risk that an investment does not make the positive societal impact for which it was designed.

2. An investment’s impact can be measured, but the measurement is subjective and based on an investor’s values.

The amount of impact that an investment provides is uncertain and benchmarks can be created to provide relative measures on certain types of impact. However, measuring an investment’s impact must account for the goals and values of the person or organization making the investment.

To achieve a wider adoption of impact investing, investors will need a better understanding of how impact fits into the larger investment universe.

For example, microcredit is a type of banking service that is provided to unemployed or low-income individuals or groups who otherwise would have no other access to financial services. The ultimate goal of using microfinance is to give those in poverty an opportunity to significantly raise their standard of living. Microcredit, as a financial tool, is considered a success by some and a failure by others in achieving this goal.

For investors that measure impact in eradicating global poverty through a job creation lens, microcredit is a failure. These investors thought that, a few years after funding impoverished entrepreneurs, their businesses would grow, creating jobs and stimulating the economy, thereby, helping their communities to rise out of poverty. Unfortunately, not everyone seeking micro-loans and credit had the next big idea that will drive their country into becoming a major global player, which means that most micro-loans will not be significant on a global scale.

For investors that measure impact through a gender inequality lens, microfinance is a huge success. The majority of microcredit’s first-time borrowers are women whose income is near the poverty line. In 2016, microfinance institutions (MFIs) reached 132 million low-income clients with a loan portfolio worth $102 billion. The total number of borrowers in the global microfinance space was estimated to reach 151 million in 2018. Those statistics clearly show that women benefit greatly from microfinance.

3. Impact has risk separate from financial risk.

Financial risk is the risk that an investment will not reach its targeted rate of return. Impact risk is the risk that an investment will not provide its targeted social impact. These are two distinct risks that should be evaluated separately.

The relationship between impact return and financial return cannot be assumed.

The measurement of financial risk is well established, in the use of such standard financial tools as standard deviation, beta, Value at Risk and more. Impact risk is a bit more difficult to quantify because it involves two elements. The first and more obvious is the risk that a particular investment will not reach its stated impact goal. Whether an investment’s impact goal is environmental, job creation or diversity, there is always the risk that a particular investment does not have a large enough social/economic impact to justify the investment.

The other impact risk is a bit more subtle. It is the risk that an investment will meet its impact goal but, also deliver negative unintended consequences. For example, the microfinance model, that is currently being used in impoverished communities throughout the world, has positively affected women, by giving them the ability to start their own small businesses. The investor impact goal of women being able to lift themselves and their families out of poverty and gain financial independence has, in many cases, been achieved.

However, through the empowerment of these women business owners, there has also been an unexpected rise in domestic violence in some of the male dominated societies where these loans are provided that has been directly tied to these microfinance programs. This is, of course, an unintended consequence that when measuring the overall social good of the program, provides a negative contribution.

4. There is not a steady relationship between impact return and financial return.

While the traditional framework, which maintains that there is a financial cost to impact, may hold true for some investments, it should not be the pervasive assumption when contemplating an impact investment. In fact, in some cases, the financial return of an investment may be directly linked to the amount of impact provided by that investment.

For example, an activist investor might invest in a poorly performing company with a less-than-stellar governance record with the purpose of driving change that will improve its internal controls, diversify the board’s composition thus making the company more attractive to current and future clients and investors. Arguably the investor’s ability to bring about such change will directly affect the financial returns of the company while also providing social good.

Another example of a company’s financial return being linked to the impact it produces can be found in the manufacturing sector. A company that produces a single product that has the ability to dramatically increase the energy efficiency in a given sector (e.g. automobiles) can lower carbon emissions. A greater adoption of this technology will result in more product sales. This will provide a positive environmental benefit, while directly increasing the company’s financial return.

A real world example that illustrates this point is NextEra Energy (NYSE:NEE). The company is the one of the world’s largest utility companies and one of the largest producers of wind and solar energy on the planet. The company’s financial profitability and environmental impact are both tied to its ability to produce renewable energy efficiently.

These examples are not meant to argue for a positive correlation between social return and impact return, but rather illustrate that the assumption that there is a financial cost to investments with social impact is flawed and the relationship between impact return and financial return cannot be assumed.

Conclusion

While investors have been slow to adopt impact investing, we hope to have created a better understanding of some its key elements, to allow investors to feel more comfortable in making such investments.

We have also presented a framework which allows for the evaluation of impact investments. The premise of this framework is that the relationship between impact return and financial return cannot be assumed and investors must evaluate the risk/return profile of the investment’s financial return and the risk/return profile of the investment’s potential impact result separately.

By completing both of these evaluations, a deeper and more holistic understanding of potential investments can be gained that will help investors clear many of the investment hurdles previously presented and make them more comfortable and confident to make future impact investments.

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Philly daily roundup: East Market coworking; Temple's $2.5M engineering donation; WITS spring summit

Philly daily roundup: Jason Bannon leaves Ben Franklin; $26M for narcolepsy treatment; Philly Tech Calendar turns one

Philly daily roundup: Closed hospital into tech hub; Pew State of the City; PHL Open for Business