The 2020-founded SaaS startup Passthrough has raised a $5 million seed round, its founders announced Tuesday.

Passthrough automates, distributes, executes and manages the subscription process for fund managers and their investors. VC firm Positive Sum led the round, with participation from Okta Ventures, Great Oaks VC and Company Ventures, as well as from strategic angel investors including Crossbeam’s Bob Moore. The round will go toward expanding the product’s rapid growth, CEO Tim Flannery told Technical.ly.

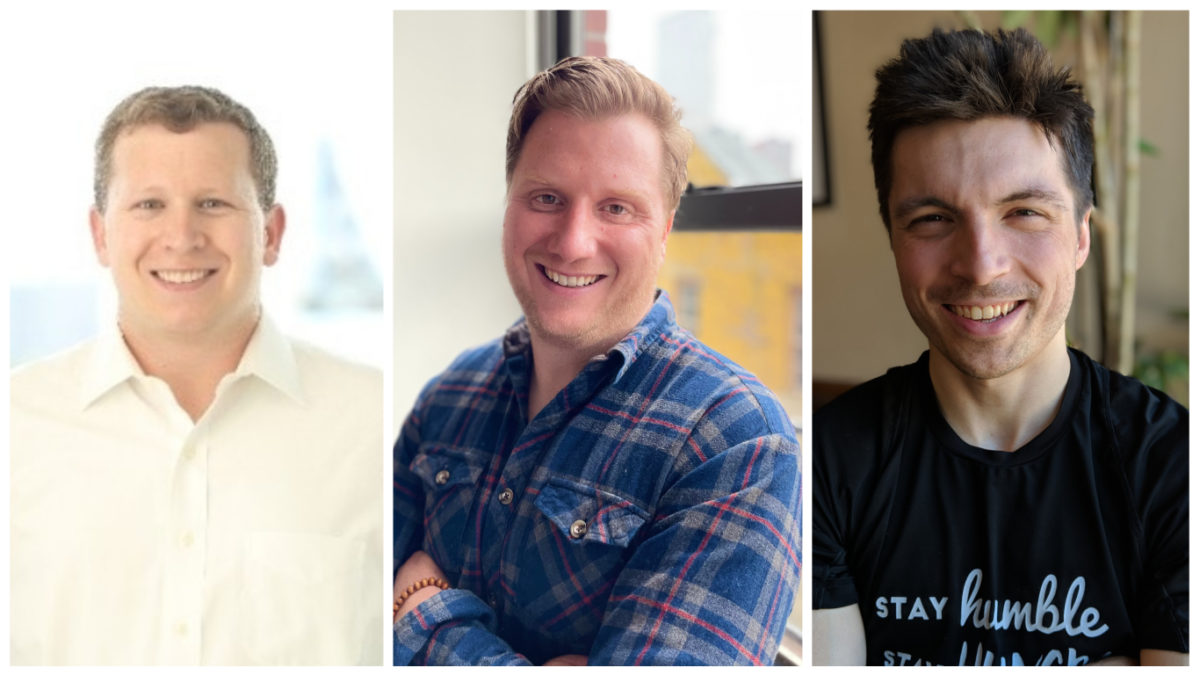

The fresh funding will also go toward continuing to grow the company’s team, which went from three founders — Flannery, Ben Doran and Alex Laplante — to 17 people in about six months.

As Flannery told us in July, the trio had all worked at Carta, which services the investing space, and experienced the clunkiness of completing subscription agreements. With Passthrough, they aimed to invite everyone into the process, while creating some transparency and a more seamless workflow. Through its platform, fund managers are able to to collaborate with their advisors and service providers in closing funds across private equity, real estate, venture capital, and other private investment vehicles. It also captures data from investors that they can choose to replicate across platforms, creating an “investor passport” for more seamless logins.

The company had previously been bootstrapped, though working through the fundraising process as a company that serves the space provided a pretty great way to explain the product — “everyone understood the problem we’re solving here,” Flannery said.

“I didn’t need to convince people that subscription documents were needed,” he added. “We were more moving on to why it’s a venture back-able business.”

They learned a number of things from fundraising for the first time, including that they were able to skip putting together a pitch deck in favor of a memo that would highlight the team’s strong writing. They had also been looking to test what was and wan’t clicking, and conversations with investors took off fast.

“We’re totally thrilled with Positive Sun, but there’s a number of conversations I would have had more in depth,” Flannery said of the round’s lead investor. “If I were a company looking to raise seed money soon, I would say go out earlier than you think to test the waters and soak up as much as you can.”

Robert Moore. (Courtesy photo)

They also learned the value in what investors can bring to the table outside of just money. The operational expertise and industry experts that they’ve connected with have proven to bring a lot of value to the table, Flannery said, especially Moore, who recently walked them through how to have their first board meeting.

“Knowing he’s on the table, and happy to pick up a call has helped improve outcomes,” he said of the twice-exited Philly founder.

Some changes coming down the line include focusing hiring on revenue, design and engineering teams with likely 10 or so roles added over the next six months. The founding team initially was spread between Philadelphia, Silicon Valley and NYC, but Laplante recently moved to Fishtown from the West Coast to meet the already local Flannery, and the founders said they like building a team between Philly and New York. (See open roles here.)

Flannery added that in 2022, the company’s goals include emphasizing its position as an API-driven businesses that could integrate into whatever big thing comes along next. It was a key part of Positive Sum’s investment, cofounder Patrick O’Shaughnessy said in a statement.

“The subscription agreement product the team built demonstrated the first step towards the kind of infrastructure the investing world needs, and customers truly loved working with them,” O’Shaughnessy said. “I believe Passthrough can be the dominant leader in fund workflow automation.”

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

3 ways to support our work:- Contribute to the Journalism Fund. Charitable giving ensures our information remains free and accessible for residents to discover workforce programs and entrepreneurship pathways. This includes philanthropic grants and individual tax-deductible donations from readers like you.

- Use our Preferred Partners. Our directory of vetted providers offers high-quality recommendations for services our readers need, and each referral supports our journalism.

- Use our services. If you need entrepreneurs and tech leaders to buy your services, are seeking technologists to hire or want more professionals to know about your ecosystem, Technical.ly has the biggest and most engaged audience in the mid-Atlantic. We help companies tell their stories and answer big questions to meet and serve our community.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

From rejection to innovation: How I built a tool to beat AI hiring algorithms at their own game

Where are the country’s most vibrant tech and startup communities?