Getting venture investment deals done involves relationships between individual companies and venture firms. But global events can still have a big impact, according to a report published Thursday from Fulton-based cyber startup foundry DataTribe.

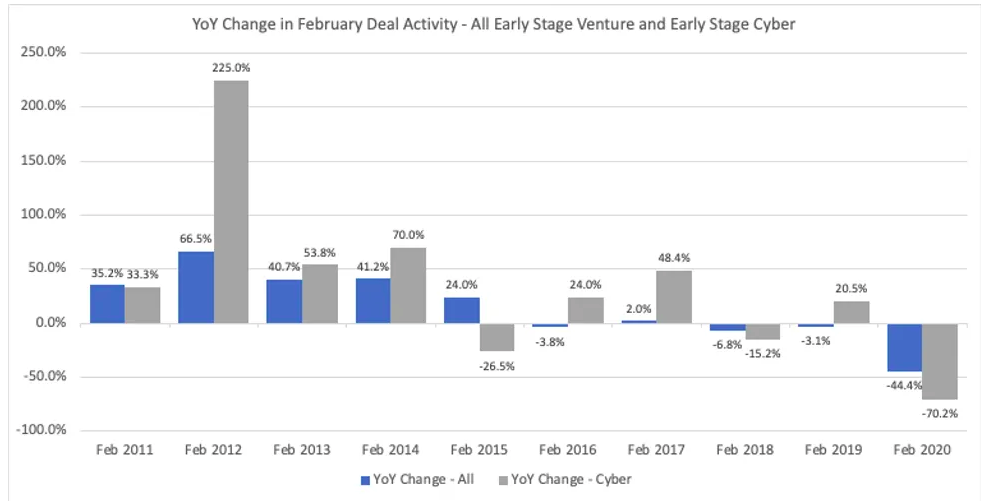

Even before COVID-19, early-stage startup investment activity was already down in the first two months of the year. In February, the analysis found that deal volume is down 44.4% for all startups over the same month of 2019, and 70.2% for cyber deals. The dip started being noticeable at the end of 2019, the report states.

DataTribe Chief Product Officer John Funge points out that many venture deals come about over a three- to six-month cycle, with the checks that are ultimately written come at the end of that period. So even as venture deals dipped, it’s likely that forces were at work even before COVID-19 started having a big impact.

“The fact that we’re seeing deals slowing down to some extent at the end of 2019, I think, speaks to the increased geopolitical uncertainty we were seeing at the end of last year,” he said.

He pointed to events like trade negotiations between the U.S. and China, geopolitical events in Iran and impeachment proceedings in the U.S. that were having an effect on markets.

The report states that the “downward pressure” coming as a result of those events is likely to continue as a result of COVID-19.

(Chart via DataTribe)

It comes amid a big dip in the stock market, where investors put their money behind publicly traded companies. They’re different audiences, but what’s happening in the markets has an effect on angel investors and seed funds, Funge said. As an overall group, they’re likely to have some portion of investment in the public market, so they might become more conservative as their portfolio slows.

It’s also worth remembering that venture capitalists have to raise money, too. The money that is invested in startups comes from other funds, many of which are also invested in the public markets. So if there’s a pullback in public markets they equally might not have as much of a percentage of their portfolio to allocate toward startup investment.

That doesn’t mean that venture capital funding will be totally scarce, but the conditions add a “layer of financial risk” as investors approach startups, Funge said.

“Investments will be continuing forward, but it is likely that they will take a little bit longer to close,” he said. “There’s probably going to be a stepped-up quality bar.”

Investments will be continuing forward, but it is likely that they will take a little bit longer to close. There's probably going to be a stepped-up quality bar.

That means they will want to see more of what they typically already seek out: traction with customers, proof points and a more compelling story and differentiation from the rest of the market.

For its part, DataTribe is “open for business” and hasn’t changed its plan, Funge said.

The firm invests in about three early-stage cybersecurity and data science companies a year that are founded by folks who often worked inside the region’s intelligence community institutions. The DataTribe team, which is made up of experienced entrepreneurs and startup operators, works alongside the founders to bring expertise in areas like product management and go-to-market strategy that are key to building a commercial product company, often for the first time. It’s worked with companies that have made local funding splashes such as Dragos, Enveil and Prevailion.

The close contact puts DataTribe in a good position to work with founders and think through how their sales cycle will be impacted and how they seek to reach the milestones that can propel them to a new level of funding.

Overall, Funge said DataTribe’s investment analysis shows general growth in cyber investments over the last decade, despite the recent downturn.

Cyber companies have become a larger share of startups that get early-stage funding, and it’s been growing in the D.C.-Baltimore region as well, he said. Given the talent pool in the area that DataTribe is tapping into, he believes it remains well-positioned to back companies that can stand out. The team’s thesis is built around the idea that the region is home to the nation’s top cyber talent working on problems ahead of the private sector, and they don’t see that changing.

And while venture investing as a whole may change, the need for security as attack surfaces appear and remote work increases may only grow.

“At the really early seed stage,” Funge said, “that bubbling stew of entrepreneurship and innovation doesn’t really slow down. There are a lot of great reasons to continue to be optimistic in the fact that the D.C.-Baltimore region is in fact rising in this cyber context both locally, as well as nationally.”

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Baltimore daily roundup: An HBCU innovation champion's journey; Sen. Sanders visits Morgan State; Humane Ai review debate

Baltimore daily roundup: Medtech made in Baltimore; Sen. Sanders visits Morgan State; Humane Ai review debate

Baltimore daily roundup: The city's new esports lab; a conference in Wilmington; GBC reports $4B of economic activity