If you’re still waiting for fintech to explode in Delaware, you may be looking at it in terms too narrow.

“It already has,” says John Taylor, director of economic research for the Delaware Prosperity Partnership, who recently completed an in-depth report on fintech in Delaware along with First State Fintech Lab and University of Delaware’s Institute for Public Administration.

The view that fintech has yet to truly materialize in Delaware is fueled by a definition that hyper-focuses on the startup sector and disregards established financial institutions as not real tech companies.

As we’ve written over the past few years, companies such as JPMorgan Chase and Capital One are tech companies. Once you factor in the evolution of banks — and their large pool of Delaware tech jobs — the Wilmington fintech boom materializes.

(Fun fact: Delaware accounted for 75% of all fintech investment in the Philadelphia region in 2018.)

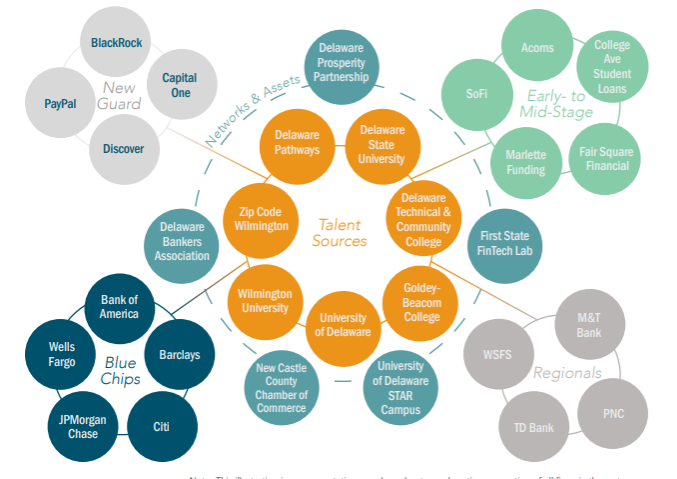

“We think taking the broad view makes a lot of sense here, particularly from a workforce angle,” said Taylor in an interview with Technical.ly. “A major reason early stage fintech companies are so interested in Delaware is because of our strength in the broader financial services space — they know they can hire folks with talent on the financial services side, the credit risk analysis side and tech talent.”

While several digital-born fintech companies such as Paypal, Acorns and SoFi have bases in Delaware, and homegrown fintech startups like Fair Square Financial and Marlette Funding continue to grow, they’re only half of the picture.

“Just focusing on the startup side of things really misses a big piece of what fintech has become,” said Taylor. “Particularly if you look at the increasing synergy between startups and established firms. We’re seeing more acquisitions in this space, as some of those larger firms look to grow their services.”

How much impact does fintech have in Delaware?

“Right now, we have the most jobs we’ve ever had in Delaware, about 465,000 jobs in the state; unemployment is 3.2%; and financial services is really a significant driver of our economy: We’ve got nearly 48,000 jobs, up from about 41,000 at the bottom of the recession,” said Taylor. “We’ve seen some pretty significant growth, and fintech accounts for about 9% of employment in the state, the highest share of any state in the country — about double the national average.

“And these jobs are at firms of all shapes and sizes,” he said. “One of the rules of our report was to help bring in some clarity and shared understanding to what that means and some of the trends.”

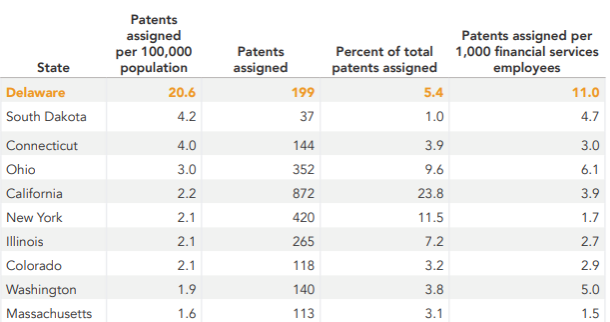

Delaware is #1 in patents issued in the United States. (Screenshot via Delaware Prosperity Partnership report)

And it’s not just jobs: “We’re not just an employment, hub, but really a hub for innovation,” Taylor said.

“One thing I found particularly interesting was that when we looked at some data over the last decade in fintech-related patenting activity, we found almost 200 over that time, which ranked Delaware first nationally on a per capita basis,” he said. “That accounts for where these companies and individuals are based, not necessarily where the patent is created. And even if we look at that, we still rank second.”

Read the full reportBefore you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The man charged in the UnitedHealthcare CEO shooting had a ton of tech connections

Delaware students take a field trip to China using their tablets and ChatGPT

From rejection to innovation: How I built a tool to beat AI hiring algorithms at their own game