What’s keeping startups afloat in major tech hubs like Silicon Valley and Boston? What about smaller hubs in and around the Northeast Corridor — like D.C., Baltimore and Philadelphia?

I think there are two components to the antidote: being in a place where startups are the cool thing to do, and chance meetings with people who can help you. And what drives them both is the number of startup people around you.

That’s what programmer and venture capitalist Paul Graham wrote in a 2011 essay called “Why Startup Hubs Work.” Delaware — Wilmington in particular — is most definitely a place where startups are the “cool thing to do.” Between startups and freelancers at coIN Loft, the growing number of tenants occupying 1313 Innovation and the steady stream of entrepreneurs being churned out of University of Delaware’s Horn Program in Entrepreneurship, there’s excitement, for sure.

But these days, that can be said for just about any environment — from midwestern cities like Lincoln, Nebraska and Cedar Rapids, Iowa to northeastern towns like Burlington, Vermont and Portland, Maine. In 2015 America, launching a startup is a “cool thing to do” no matter where you are. The idea of the “rise of the rest,” as espoused by investor Steve Case and others, means that all these places are in play for innovation, forming a pulsing constellation of tech entrepreneurship.

Which brings us to Delaware. Does Delaware have the necessary elements and infrastructure to keep its startups afloat and in place?

“In our own way, yes,” said Mike Bowman, whose Delaware Technology Park, in collaboration with UD, is successfully building out a wet lab, called the STAR Campus, in Newark. Bowman alluded to a 2013 Kauffman Foundation study of U.S. entrepreneurship. In the study, Delaware boasted the highest increase in entrepreneurial activity rate over the past decade.

“That momentum has continued but what I would call it is organic growth,” said Bowman, citing Incyte and SevOne as examples of startups that grew organically in Delaware. “It’s not ‘lasso ’em and see what we can drag in here’ — that’s not the way it’s ever going to work in Delaware. We do not have the funding or the size to do that.”

Delaware doesn't have enough local talent to build these companies.

“Size” is critical, and it’s something Delaware just does not have.

“The best thing a state or region can offer is a highly educated workforce with the right skills for employers,” said Troy Mix, a policy scientist at UD’s Institute for Public Administration.

The importance of universities

For the past four years, Mix has been studying university involvement in economic development. His focus? The role elite universities have played in the development of places like Silicon Valley, Boston and the Carolina Research Triangle — and, importantly, how to mirror that economic impact in areas that don’t have elite universities.

Frugal #innovation requires #highered to move from “we have the knowledge and you can use it" toward co-production http://t.co/uMIBhchq5d

— Troy Mix (@TDMix) November 26, 2014

“What’s the role of not just the patenting activity and the high-tech research going on at these universities, but the role of centers — like the one I’m employed at now — outreaching to the community?” said Mix. “There is a key role in terms of building the ecosystem and having these conversations going: having groups in place that are trying to improve their workforce, looking at policies that might be improved upon. All these lessons are in places like Silicon Valley.”

Does Mix see that happening in Delaware — particularly with the University of Delaware?

“The successful [universities] play a different role than commonly conceived. They’re not just a factory of patents,” said Mix. “That can be part of it, but it’s also that the university is laying out a vision for the region and helping to convene those discussions. I think probably a lot of that is already in place.”

Funding problems?

There is something of that ilk happening in Wilmington, as Paul McConnell continues his campaign to lure the University of Delaware to Wilmington. How is McConnell, a real estate developer whose 1313 Innovation continues to expand, leading the tech charge? More specifically, where is the presence of Delaware angel fund First State Innovation (which McConnell is a part of) and its venture capital firm offshoot, Leading Edge Ventures?

“Delaware does not have an environment to do anything other than kill a startup,” said Keith Elliott, a Delaware resident and former Barclays dev now working as a Senior Application Architect at fintech startup Moven, which is based in New York but has a dev team in the Philly suburbs.

WTH isn't Wilmington a tech hub? No sales tax. Access to Philly DC NYC B-more. Inexpensive. That city needs a revolution. #Delaware #tech

— Michael Reb (@michael_reb) September 22, 2012

“Startups need access to capital, support, and talent. We don’t have real angel investors that actively invest in Delaware companies,” he said. “The perception by entrepreneurs and technologists in the area is that you may want to stay in Delaware to run your company, but we will surely have to leave the area to find investors to provide capital.”

Elliott has a point. Wilmington alone has seen that happen to some of its most beloved up-and-comers: Kurbi and USEED, with Cnverg spending half of its time in Philly and the other half in Wilmington (or abroad).

Elliott said the flight of successful startups out of Delaware leaves the state’s early-stage companies, entrepreneurs and ideas in the dust.

“Delaware doesn’t have enough local talent to build these companies,” he said. “Those that have relevant skills opt to work at established companies in Delaware or leave altogether to pursue opportunities in Philadelphia.”

I am so excited about the future for northern Delaware and Wilmington in particular in the financial technology sector.

Finding capital, Elliott adds, is difficult no matter where you are. However, he said, First State Innovation doesn’t have the best track record of investing in local companies.

“If they are actively investing, it would help to change the ‘lack of angels’ perception by listing what deals and how much they have invested in each company over the last six months [on their website],” he said. “Actually, even knowing when their last significant investment was could be encouragement to would-be and current entrepreneurs.”

Bowman, who’s also a general partner at Delaware’s fledgling VC firm Leading Edge Ventures, said local startups just aren’t ready for venture capital — actually, most local entrepreneurs don’t even understand the process correctly.

“They don’t understand the requirements of venture capital investing,” Bowman said. “The No. 1 term is, how and when are you going to exit? Because we want our money back, times 10. That’s not what people want. They just want money without any strings.”

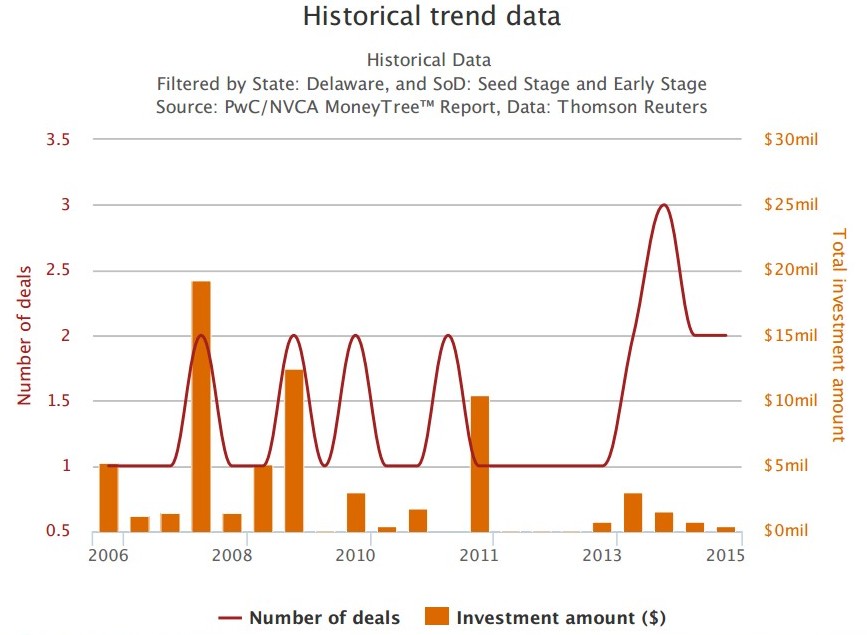

According to Bowman, Leading Edge Ventures will have completed about four deals by the time they plan on publicizing their record this coming fall. According to recent investment trend data from the MoneyTree Report from PricewaterhouseCoopers and the National Venture Capital Association (with data from Thomson Reuters), Delaware did see a surge in seed and early-stage investment from 2012-2014 in the biotech, financial services, computers, software and IT industries.

- Q4 2011 to Q3 2013: 0 deals made

- Q4 2013: 1 deal, $814,000 total

- 2014: 7 deals, $5,415,000 total

- Q1 2015: 2 deals, $400,000 total

“It’s a misunderstood game,” Bowman said. “[Founders] don’t ever want to give up the CEO role. You take other people’s money? Venture capitalists can put you out on the street, and it happens all the time.”

Maybe not

Bowman believes Delaware needs to “pick the spots” it’s good at. Personally, he has faith in both the patenting activity happening in the research park arena and Wilmington’s fintech scene, as well as the services surrounding cybersecurity and big data that support it.

He’s not alone.

“I am so excited about the future for northern Delaware and Wilmington in particular in the financial technology sector,” said Jeff Flynn, Wilmington’s Director of Economic Development. That future, according to Flynn, includes growing the city’s existing fintech companies, attracting new ones, and the potential for startups founded by experienced fintech devs.

Wilmington should be proud of its big banks, said Flynn.

“Nothing drives somebody to change their location like a job,” he said, adding that upcoming coding boot camp Zip Code Wilmington will be a big player in getting more mass in Wilmington. “It’s all about making sure the future of Delaware and Wilmington, in my view, is capitalizing on [fintech] and making sure our workforce is top notch in that sector, that we continue to increase the number of workers in that force.”

Government’s role

Elliott, the Moven developer, is a little more skeptical of local government’s support of entrepreneurship and technology.

“In the same way that our economic development offices actively pursue large companies with tax incentives to come to Delaware and later to remain in Delaware, the same principles could be used to support startups,” Elliott said. “When the city or state takes an active role in supporting a startup, it provides the needed help to buy the company time to prove business models and keep operating. In the long run, the city and state would still receive tax income from the new jobs created.”

The state did support startups through public-private partnership Start It Up Delaware, which relaunched coIN Loft just over a year ago with $250,000 in state economic development cash. Nowadays, the coworking space is occupied by more freelancers and remote corporate workers than startup companies. With Cnverg in and out of the space, Health for America moving next year’s fellowship to D.C. and Carvertise soon moving to 1313 Innovation, only a handful of tech or tech-adjacent startups remain. Has Start It Up Delaware — well, started it up? All signs still point to “yes.”

But Delaware needs more, and every discussion involves the state’s universities — especially the University of Delaware.

According to Mix, university involvement is what led to the success of ecosystems such as Silicon Valley, Boston and the Carolina Research Triangle.

“It wasn’t that [those places] were asking the state for money to support their effort,” he said. “It was that they were laying out a vision for what this place will look like in 20-40 years and help us make that a reality.”

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Delaware daily roundup: Delmarva Power vendor stats; DelDOT's $15M federal grant; 50 best companies to work for

Delaware daily roundup: Over 4,000 Black-owned businesses uncovered; Dover makes rising cities list; a push for online sports betting

Delaware daily roundup: Ladybug Fest illuminates small biz; Hahnemann Hospital's biotech future; intl. politics and a Middletown project