As the Philadelphia region continues to grows its prowess in the life sciences sector, the buildings with available lab space are struggling to keep up with demand, a new CBRE report shows.

The real estate firm’s data showed that University City, where much of the region’s life science activity is located, had become the fifth fastest-growing North American neighborhood in terms of office rent. But the speed at which life sciences companies are putting down roots in Philadelphia is causing a supply and demand problem.

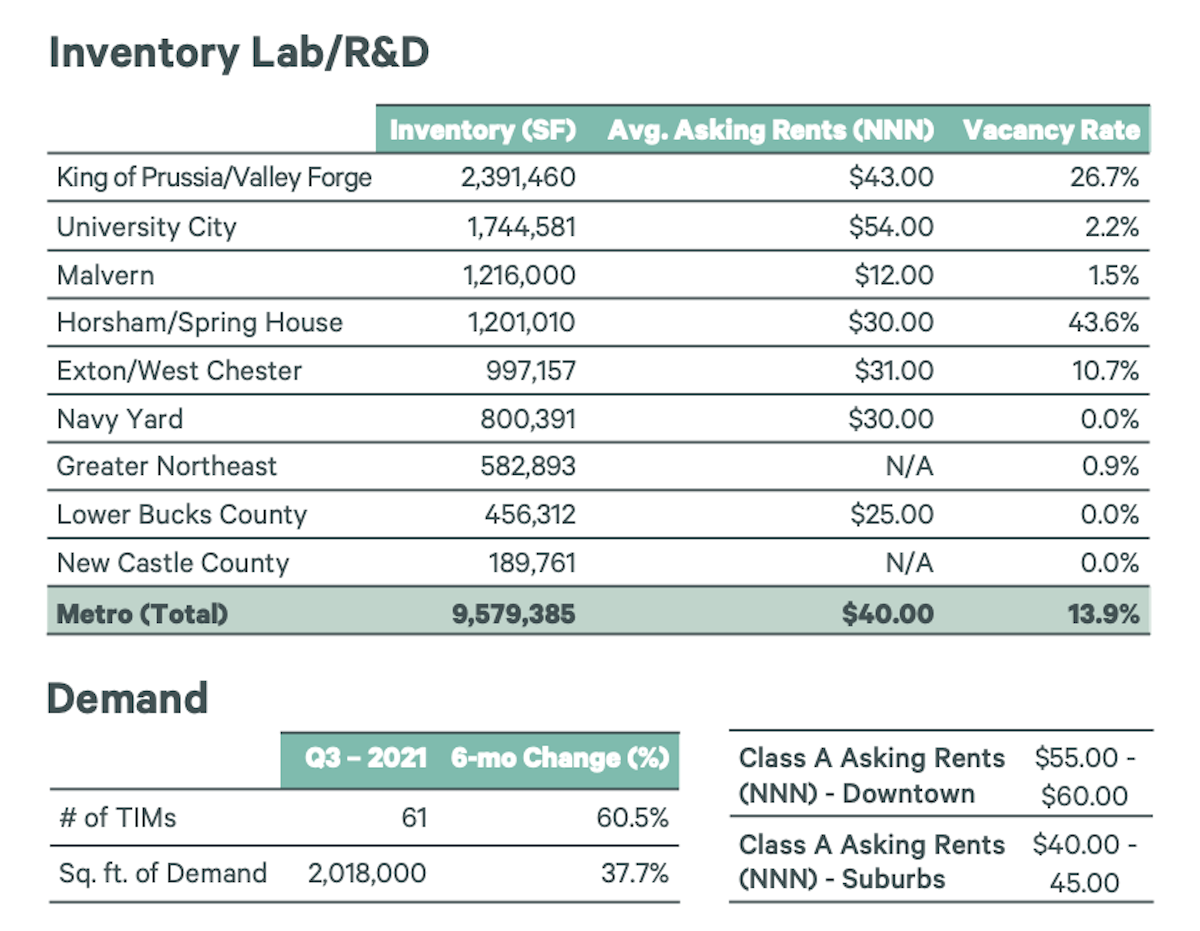

The region is already home to nearly 10 million square feet of life sciences inventory, and has a 13.9% vacancy rate. At the same time, this latest CBRE report showed there are currently 61 tenants seeking space, with a nearly 40% increase in demand for space compared to six months ago.

See the reportThere were nearly 30 major development projects in the works as of 2019, which will add nearly 1 million square feet of space to the city’s inventory. (One newer case in point: CIC is doubling its Philly footprint.) Completion of those projects are likely still at least a year away, CBRE EVP Bob Zwengler told Technical.ly.

“There is a pretty big imbalance, with not enough supply right now,” he said. “The supply is on the way, but it’s a year or more from delivery. The demand will continue to grow during that time.”

There are life sciences hubs growing in other places in the region, Zwengler said. In the suburbs, we see areas like King of Prussia and Malvern housing mature life sciences companies and representing a lot of the area’s square footage. There are also projects popping up in the Exton area, West Chester and down at the city’s Navy Yard, making these areas attractive to life sciences companies.

The current breakdown of life sciences inventory in the region. (Image via CBRE)

But if you’re one of the 52,000 life sciences workers in the region ready to plant roots right now, what should you do? Zwengler’s seen a trend of some Center City buildings adapting to become suitable for labs. There’s been “several significant transactions” recently at the Curtis Building at 6th and Walnut streets and in 401 North Broad Street, owned by Netrality.

While many office buildings are seeing high vacancy from the pandemic, not all are the right fit to build lab space. The infrastructure has to be there, including high ceilings, air conditioning, heavier floor loads than average, and room for exhaust, Zwengler said.

It’s likely this supply and demand issue will persist, as there’s no sign of the industry slowing down in Philadelphia, especially for those working in cell and gene therapy. And the interest from local and other investors, which has been steadily on the rise since 2018, will continue to push this growth forward.

Before you go...

Please consider supporting Technical.ly to keep our independent journalism strong. Unlike most business-focused media outlets, we don’t have a paywall. Instead, we count on your personal and organizational support.

3 ways to support our work:- Contribute to the Journalism Fund. Charitable giving ensures our information remains free and accessible for residents to discover workforce programs and entrepreneurship pathways. This includes philanthropic grants and individual tax-deductible donations from readers like you.

- Use our Preferred Partners. Our directory of vetted providers offers high-quality recommendations for services our readers need, and each referral supports our journalism.

- Use our services. If you need entrepreneurs and tech leaders to buy your services, are seeking technologists to hire or want more professionals to know about your ecosystem, Technical.ly has the biggest and most engaged audience in the mid-Atlantic. We help companies tell their stories and answer big questions to meet and serve our community.

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

The person charged in the UnitedHealthcare CEO shooting had a ton of tech connections

From rejection to innovation: How I built a tool to beat AI hiring algorithms at their own game

Where are the country’s most vibrant tech and startup communities?