Temple University’s Be Your Own Boss Bowl (BYOBB) is one of most lucrative university seed funding programs in the country — with over $200,000 in annual cash and prize giveaways. The competition features three track awards (Undergraduate, Graduate and Social Impact) and then all contestants compete for the coveted Grand Prize award which is worth over $100,000. Here is complete list of Grand Prize Winners since the inception of the program in 2000.

The BYOBB Grand Prize Winners that still have traction today, all share a common thread that the program directors should look for moving forward. This would enhance the appeal of the program and yield better results for the BYOBB portfolio companies. What is that common thread?

Hint: This Year’s Winner Doesn’t Have It

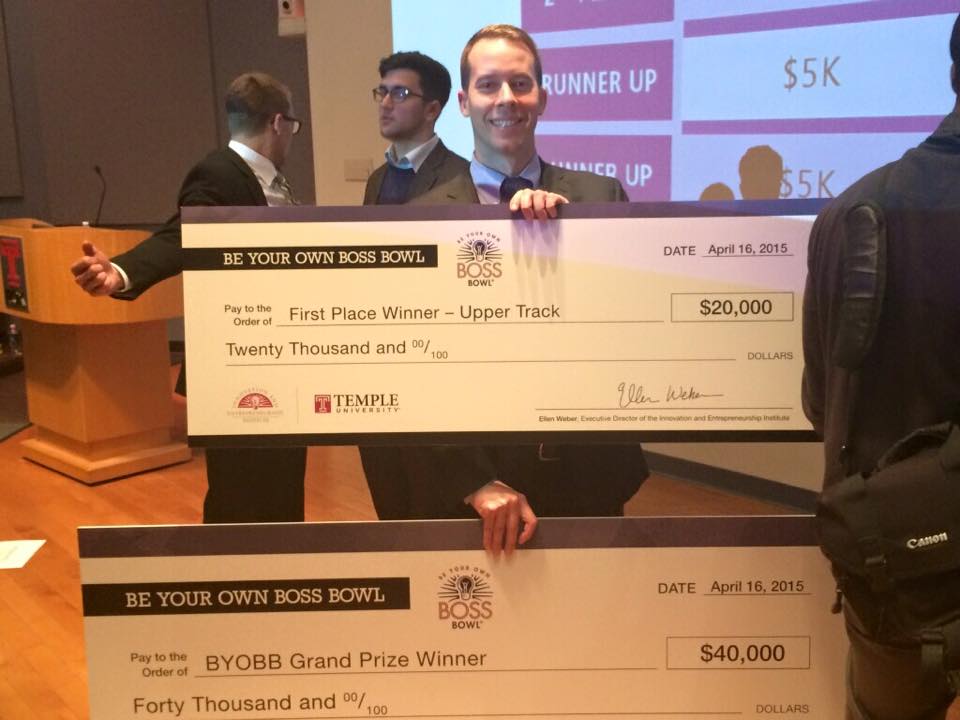

The 2015 Grand Prize Winner was Ben Stucker, who won for his online leading brokerage concept called Rates For Us. Stucker’s startup, although still in stealth mode, will compete against the likes of LendingTree and Quicken Loans by offering competitive mortgage rates. Stucker plans to provide cheaper rates by pooling lendees together, thereby leveraging their collective buying power, and then wholesaling them to strategic partner banks.

Congratulations #BYOBB2015 Grand Prize Winner and First Place Upper Track Winner @FoxAlumni Ben Stucker @ratesforus pic.twitter.com/l3zmewOmHE

— Innovation & Entrepreneurship Institute (IEI) (@TempleIEI) April 20, 2015

On paper, RatesForUs.com sounds like a great idea with big market potential (which could be huge, as 30-year fixed rate mortgages must inevitability rise above the historic lows they currently hoover around). Nevertheless, Stucker has his work cut out for him — building a financial marketplace in the face of staunch competition will not be easy.

There are significant asymmetric risks facing marketplace startups like this one. Stucker has to build the demand and supply side of the market in unison or the entire model falls apart. Rates For Us must acquire potential lendees (which requires big investments in content marketing for SEO and/or paid search advertising just to get noticed online) while, at the same time, securing banks that need leads and are willing to offer lower rates in exchange for the volume.

Although Rates For Us has an interesting value proposition — cheaper rates through collective buying power — its growth proposition was not clearly articulated during the BYOBB presentations last Friday, April 17. What are the customer and supplier acquisition costs; how does the company plan to deliver the value proposition to the critical mass (on both the demand and supply sides) before running out of money? The judges never asked these questions. Furthermore, these questions cannot be adequately answered on a business plan. You need a minimum viable product, or MVP — something Rates For Us doesn’t have yet.

Since the inception of the BYOBB competition, only 4 out of the 14 Grand Prize Winners ever hit the market with an actual product or service, and 2 out of the 4 were nonprofits — namely, 2003 winner Rebecca Davis Dance Company and 2013 winner Neighborhood Foods.

PHMhealth (2012), a home healthcare management app, and Pitbull Development (2009), a real estate company later renamed Konkrete Investments, are the only two for-profit, BYOBB Grand Prize winning entities to hit the market with a minimum viable product (and ironically, they are the most promising in the BYOBB portfolio).

PHMhealth raised $275,000 in additional financing (all debt) since winning the BYOBB competition in 2012 — the only tech startup among the Grand Prize Winners to raise follow-on money. Shawn Bullard, the former football player (and reality TV star) behind Konkrete Properties, currently owns a number of rental properties near Temple’s campus.

The MVP is the Common Thread

The BYOBB competition puts way too much emphasis on the business plans (which accounts for 75 percent of the competition). Organizers should tweak the grading rubric and give greater weight to those entrepreneurs with a proof of concept.

Business plans are useful because they help entrepreneurs identify their assumptions and the potential holes in their business model. But that’s where you draw the line. Startups need to start selling to validate those assumptions (for better or worse); no matter how good the business plan reads.

The lasting BYOBB startups each had a minimum value product at the time of the competition. Therefore, they could speak to specific market conditions as opposed to intellectualizing data on a plan, which makes a world of difference. Mike Tyson said it best, “Everybody has a plan until they get punched in the mouth.” How fitting are his words in the context of a startup competition like the BYOBB?

When startups launch an MVP, they step into the proverbial ring, and we find out just how good they really are. Until then, there’s not much to evaluate them on. The business plan just doesn’t suffice. First Round Capital founding partner Josh Kopelman, who is one of the best seed-stage investors in the country, had this to say in 2013: “There’s one thing I’ve learned about entrepreneurs’ business plans. Every one is wrong.”

At the seed stage (in which the BYOBB participates), the best practice is to bet on the founding team with a proven concept. Eric Ries writes, in the Lean Startup, that a proven concept consists of a validated value proposition and a validated growth proposition. A minimum value product kills both birds with one stone and increases the odds of startup success. That certainly appears to be true in the case of the BYOBB Grand Prize Winners.

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Philly daily roundup: East Market coworking; Temple's $2.5M engineering donation; WITS spring summit

Philly daily roundup: Jason Bannon leaves Ben Franklin; $26M for narcolepsy treatment; Philly Tech Calendar turns one

Philly daily roundup: Closed hospital into tech hub; Pew State of the City; PHL Open for Business