How can you get a 100x return on your investment? It’s time to go “big game hunting” in search of the next big winners.

In my last column, I explored success stories from the past 50 years. Many of these company were brands that we all know of today — Disney, Microsoft, Amazon and Walmart.

According to Christopher Mayer’s excellent book, “100 Baggers: Stocks that Return 100-to-1 and How to Find Them,” many of these investments had a few things in common:

- They almost all started out as small companies

- Superior annual growth in both sales and earnings (ideally, 15% or higher for each)

- The ability to gain a higher valuation multiple based on those earnings

- Profitable reinvestment of cash flow, generating a ROIC (return on invested capital) of 15% or more

- Quality businesses, with consistent leadership and performance

- Customer loyalty, as truly successful enterprises often have a broad “moat” that can protect them from their competition. It could be based on superior pricing (Walmart), intellectual property (Apple/Disney), niche market (Nvidia), or network effects (Amazon/Google)

- Founder-led businesses seem to outperform those that bring in leaders from the outside

The most important element to growing your 100 baggers is time. We are talking about years to decades. If your stock grows at 15% per year, it will take 33 years to generate 100x gains.

(Fortunately the amount of time needed to generate gains of this magnitude seems to be getting shorter, thanks to the rapidly scalability of internet and digitally native businesses.)

Venture capitalists have learned that 75% of all startups fail. However, the profits from the 25% that succeed will often compensate for those losses. So, you can’t just find ONE perfect investment and hope for the best. It helps to have multiple worthwhile ideas.

When making sense stopped making sense

For the first 25 years of my career, I was obsessed with learning everything that I could about investing. I read over 100 books on the subject. Passed the hardest exams in finance. Learned obscure trading techniques. But what I found out (from experience) was that my training mostly just helped to manage risk. My conventional stock picks didn’t lose money, but they also didn’t generate exceptional gains for anyone.

This is because something new started happening after 2010: Many of the companies that were growing the fastest and grabbing headlines were simply not generating any earnings. This made it difficult to apply traditional investing tools with any success.

Meanwhile, I was generating huge profits on ideas that seemed a little crazy. I got in early on a number of different themes — including cryptocurrency, OLEDs, immuno-oncology and synthetic biology.

I did this by starting at the fringe and tracking the “story” behind emerging technologies and trends. The basic idea is to ask a few key questions:

Is it real?

Do people want it?

Can they pay for it?

Is it an easy story to tell?

The answer to all of these questions should be yes. If you can’t check all of the boxes, then something is probably wrong. Either the project won’t succeed, or it is simply too early for an investment.

Some electric car stocks soared on hype and then fizzled based on failed expectations, such as Nikola Motors, which was supposed to be “the next Tesla.” There has been a lot of buzz lately around space companies. It’s the hobby of billionaires, but nobody can else afford to play. So, I’ve steered clear from these stocks. Meanwhile, cryptocurrency was a difficult story to tell for a long time. Many institutional investors still don’t “get it,” while the technology keeps getting better and better.

When a story goes from fringe to mainstream, there is often serious money to be made.

Where to look for 100x gains

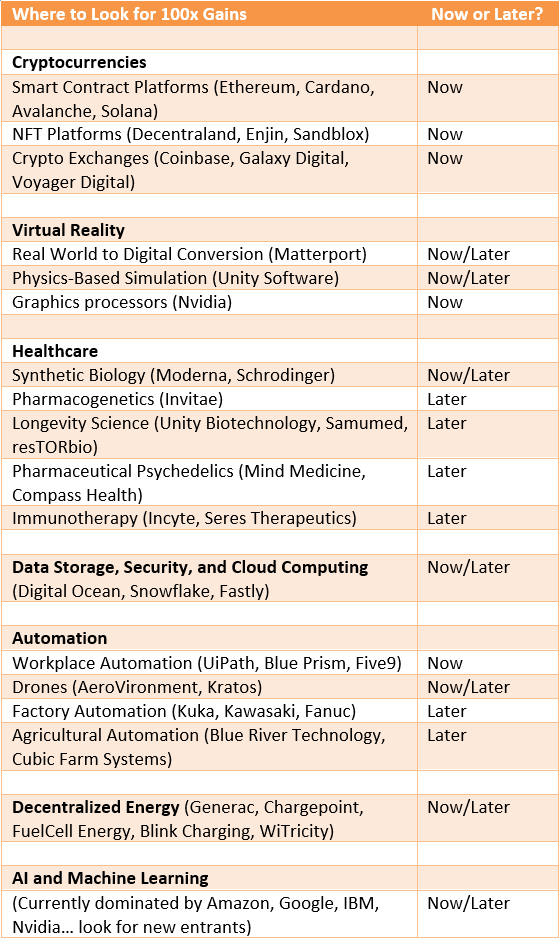

Putting on my futurist hat, I’m seeing a few areas that could generate outsized gains. We’re going pretty far out here; accuracy is not guaranteed. Your mileage may vary.

A few of these companies are seeing great momentum now, others are worth looking at later. Many of these ventures are not showing profits, and some will run out of cash before they reach maturity. After a decade or longer, a few may succeed beyond anyone’s wildest expectations.

Trade at your own risk. Hold onto your winners while keeping your losses small and survivable.

(Image by Jim Lee)

The view is always better from the edge. If you do what everyone else is doing, you’ll probably get similar results. In order to get exceptional returns, you may need to do something different. This takes foresight, independent research, and a little bit of luck.

P.S. Just for fun: Check out this 10-minute video on how I’m using artificial intelligence here at StratFI.

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Delaware daily roundup: Delmarva Power vendor stats; DelDOT's $15M federal grant; 50 best companies to work for

Delaware daily roundup: Over 4,000 Black-owned businesses uncovered; Dover makes rising cities list; a push for online sports betting

Delaware daily roundup: Ladybug Fest illuminates small biz; Hahnemann Hospital's biotech future; intl. politics and a Middletown project