Tax delinquents cheat the city and the School District out of $298 million a year, according to a recent Philadelphia Inquirer/PlanPhilly report.

Who else loses? Homeowners.

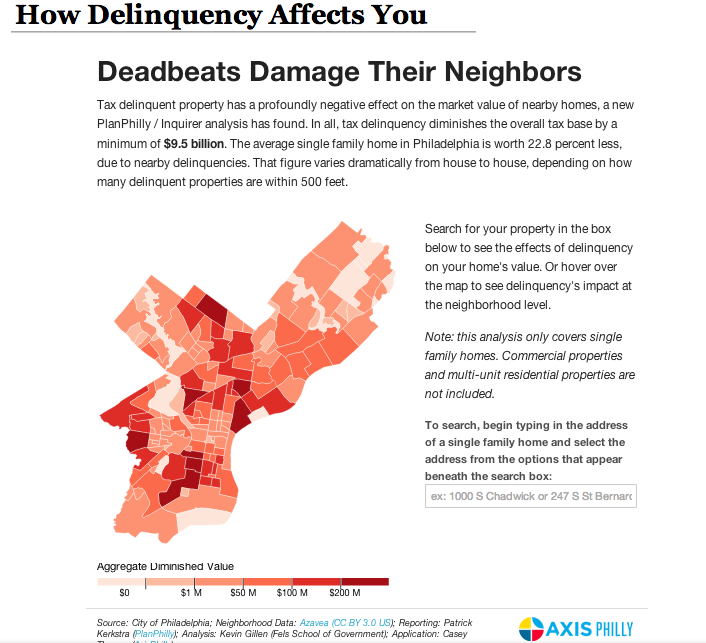

Property tax delinquencies lower the market value of a single-family home, on average, 22.8 percent, according to another Inquirer/PlanPhilly report.

Meanwhile, investors win.

“Of the roughly 100,000 tax-delinquent properties in Philadelphia, at least 57,500 are owned by investors, not occupants,” the Inquirer/PlanPhilly reported. Read that story here.

Among others, former Inquirer City Hall beat reporter Patrick Kerkstra led the reporting project, with PlanPhilly editor Matt Golas on strategy..

Find the whole tax delinquency series on PlanPhilly here.

The city announced a $40 million effort, largely driven by new software, to crack down on tax delinquents last month.

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Philly daily roundup: East Market coworking; Temple's $2.5M engineering donation; WITS spring summit

Philly daily roundup: Jason Bannon leaves Ben Franklin; $26M for narcolepsy treatment; Philly Tech Calendar turns one

Philly daily roundup: Closed hospital into tech hub; Pew State of the City; PHL Open for Business