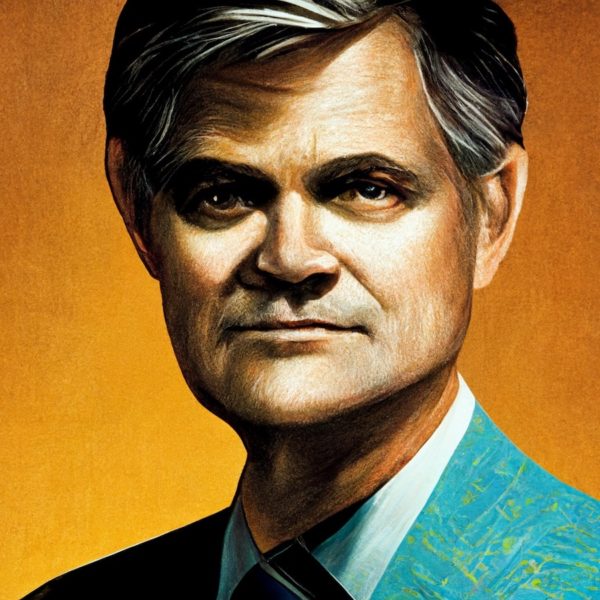

Inside the museum, throngs of entrepreneurs and startup scenesters exchanged pleasantries. Hors d’oeuvres were passed and domestic beer was swilled. A stage was set for a cohort of entrepreneurs to present their new business ventures. It was a startup pitch competition, an event format that came into its own in the 2010s. The hundreds-strong crowd was part of a coalition led by that tech executive: Steve Case, who boasted the poise, confidence and silver hair of a movie star playing a politician.

The event was one stop of the Rise of the Rest bus tour, which rode a growing focus of urban economic development on so-called “startup ecosystems.” After the shock of the Great Recession and decades of declining entrepreneurship, civic leaders got interested in the systems that supported business creation and growth. Over the last decade, Case has been among the movement’s true leaders, and this week he launched a new book called “Rise of The Rest: How Entrepreneurs in Surprising Places are Building the New American Dream.”

“It’s not just happening in a few places. This is a broad-based phenomenon, across dozens and dozens of cities,” Case said in an interview with Technical.ly earlier this month. “It bodes well for those cities and the nation.”

How Steve Case became a local startup champion

Case secured his entrepreneurial stardom in the 1990s as the cofounder and CEO of what became Aol — known as the first internet company to go public, that decade’s highest-performing stock and one-half of what became one of the largest mergers in American business history. In 2005, he helped launch Revolution, the DC-based investment firm. A critical part of Case’s story is that he grew his companies far from Silicon Valley, the internet economy’s cultural heart.

For both political and cultural reasons, some worried about an over-reliance on Silicon Valley innovation. Something had to be done. In 2011, Case was named the founding chair of the Startup America Partnership, an Obama-era White House effort to accelerate high-growth entrepreneurship throughout the country.

It’s in that role that Case latched onto “Rise of the Rest,” a concept first popularized to describe emerging economies in an increasingly globalized world. By 2013, Case used the term to describe growing regional hubs of entrepreneurship, and his firm even trademarked the phrase. The focus coincided neatly with much of Technical.ly’s coverage on the surging identity of startup ecosystems; Nationwide, a growing chorus of economic watchers was singing that increasingly serious founders were launching scalable companies outside Silicon Valley.

If only someone would pay attention, they’d say. That’s why Case and team launched a bus tour to invest in just those founders. I personally attended at least three of its various tour stops, and Technical.ly followed far more. It all felt like a validation of so much local community organizing. Yet for years, Case — like Technical.ly’s own coverage — confronted one uncomfortable truth.

Despite years of organizing, events and training, very little changed in any macroeconomic sense. Each year, Americans started fewer and fewer companies. In 2016, John Lettieri, the cofounder of the DC-based Economic Innovation Group, told a US Senate subcommittee: “Millennials are on track to be the least entrepreneurial generation in recent history.”

Then the pandemic changed everything.

Initially, analysts expected entrepreneurship would collapse even further, as it had in past recessions. But the very opposite happened. Rates of business incorporation surged — and remained elevated, reversing a decades-old trend.

“This is not a blip,” one economist told Technical.ly. “Real, high-quality sustainable businesses have started.”

Women, Black and Latino founders led business formation, countering another trend, and gave rise to a bet that a decade of so-called inclusive entrepreneurship investing is finally paying off too.

“I think it’s a real tipping point. Real work has happened for a decade and in some places longer,” Case said. “It’s a ‘shake-the-snow-globe’ moment.”

Can the rise have business goals and civic ends?

What a convenient backdrop for the release of his book, which features stories from dozens of entrepreneurs with inspiring stories across the country. Most of the meetings followed a selection process between Revolution and local partners across the years-long, 47-stop Rise of the Rest bus tour, which his team said covered 11,000 miles.

“Yeah, he really rode in that bus for at least some of those miles,” said one of the partners from the 2015 Baltimore event. Case, that bus and his entrepreneurial message became symbols of hope for beleaguered regional cities, that organizer said. Or, as one of the founders of Sisu Global Health, who pitched that night, summed up the momentum she felt in her adopted hometown: “This is a testament to why we moved our company to Baltimore.”

Case has dug in on evangelizing entrepreneurship far and wide. Within Revolution’s portfolio, his team in 2019 announced its second $150 million Rise of the Rest fund, focused on small bets in unfamiliar markets. The Case Foundation, which he and his wife Jean launched, has focused its investments on inclusive entrepreneurship and impact investing. In 2016, before writing this new book, Case published “The Third Wave: An Entrepreneur’s Vision of the Future,” which argued that the next stage of economic growth would feature tech-enabled solutions for big, real-world problems — in new places.

“Many industries that powered the nation were already spread,” Case said. “The big companies are already distributed. Can we have the same thing with new and startup companies?”

Movements, like companies, begin as acts of faith. Though Case is a prominent one, he is just one of many thousands of civic-minded startup boosters around the country. After years of what seemed like idle chatter, the entrepreneurial advocates, advisers and meetup organizers that talked up their cities across the country increasingly have real data to track progress.

The number of active private business investors located somewhere beyond the top-tier triad of the Bay Area, New York City and Boston tripled in the decade between 2011 and 2021, according to a joint analysis Case’s team produced with Pitchbook. That includes more than 1,400 new institutional venture capital firms launched, which itself incorporates a wave that uses gender- and race-focused lenses.

“It’s a huge opportunity for investors to look outside of their networks — not just geography, but with a broader and more diverse mix of entrepreneurs, who are closer to a wide range of problems,” Case said. In fall 2020, Revolution announced it would focus $2 million on Black-founded companies.

Case is a venture capitalist who speaks with an American-first idealism. His championing of entrepreneurship is a mix of economic theory and civic strategy. If fewer entrepreneurs are women, Black or from, for example, rural Appalachia, then either you assume they don’t exist, or you assume they’re missing their chance. Case bets on the latter, an adaptation of the “Lost Einstein” research on inventors. Rise of the Rest is thus not charity, but an investment thesis.

“Steve really believes in this,” one collaborator of his told me. It’s also clear, though, that Case sees this as a civic project, too. It’s inescapable that a charismatic guy traveling on a branded bus to visit entrepreneurs has all the trappings of a political campaign. Case often speaks of the American project.

“A lot of people feel frustrated and left out, and they think the ‘innovation economy’ is about a few people on the coasts doing things that might disrupt their lives and destroy their lives,” Case said. “If you offset that by backing people and companies that can create jobs in their own communities, that can change things.”

He cites indoor-agriculture company App Harvest, which was founded by Johnathan Webb in Eastern Kentucky, where it employs hundreds of employees today. It can sound like Case is selling apple pie. As one especially eager startup founder told me by text: “What American is against starting a company?”

Will the rise outlast the pandemic?

Does this startup diffusion weaken the so-called “agglomeration effects” of the American economy’s most economically vibrant corners? Isn’t the density of that region good for all of us?

“The Rise of the Rest doesn’t mean the fall or the decline of Silicon Valley,” Case said. “Silicon Valley will continue to be the leading startup ecosystem in the country, and really the pride of America and the envy of the world. It’s not going anywhere.”

Thinking back to that startup pitch event at the Baltimore Museum of Industry so many years ago, it’s easy to contrast the businesses in its collections with the startups on stage. The railroads and shipping industrialists had physical goods that needed to live in physical space. The products on display could be built anywhere.

Do the entrepreneurs and technologists who can work anywhere develop less of a relationship to wherever they do choose to live?

A few months back, I caught up with a DC-based tech founder, just the kind of person who would have attended one of Case’s bus tour stops from years ago. Before the pandemic, the founder wanted to build the next big DC tech company. Now, he’s less sure. Case’s bus tour stops were full of entrepreneurs with civic pride. The pandemic may have shuffled where those entrepreneurs live, but Case says that with the right support, they can grow great companies wherever they are. It’s why cities need to pursue people, not companies. Case says this remains the way forward.

“This is how we remain the most innovative, entrepreneurial nation in the world,” Case said. “We can make sure everyone everywhere has a chance at the American Dream.”

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Delaware daily roundup: Delmarva Power vendor stats; DelDOT's $15M federal grant; 50 best companies to work for

Delaware daily roundup: Over 4,000 Black-owned businesses uncovered; Dover makes rising cities list; a push for online sports betting

Philly daily roundup: Women's health startup wins pitch; $204M for internet access; 'GamingWalls' for sports venues