Prices go up, stocks are soaring, and everyone seems to have more money. After everyone goes to bed, we wake up and wonder, “what happened?”

The markets are a complete mess right now. And the Federal Reserve is doing its best to clean things up. It is a tedious and necessary chore.

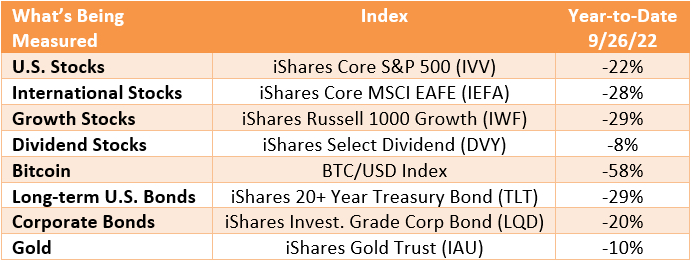

Last year, everything went up — real estate, bonds, stocks, crypto. This year, everything is down (some things more than others). Aside from oil stocks and cash, there was no place to hide.

This is truly a bear market for almost everything.

Comparatively speaking, dividend stocks have been a “safe space” — or at least better than many bond funds. We’ve been skeptical about the bond market since last year.

Meanwhile, some segments of the stock market have collapsed. For example, the Nasdaq 100 is down over -31%. The time to sell and raise cash was last December. This is not the time. We are much closer to the market bottom than the top.

(Image via Jim Lee)

Here are my notes on the current situation:

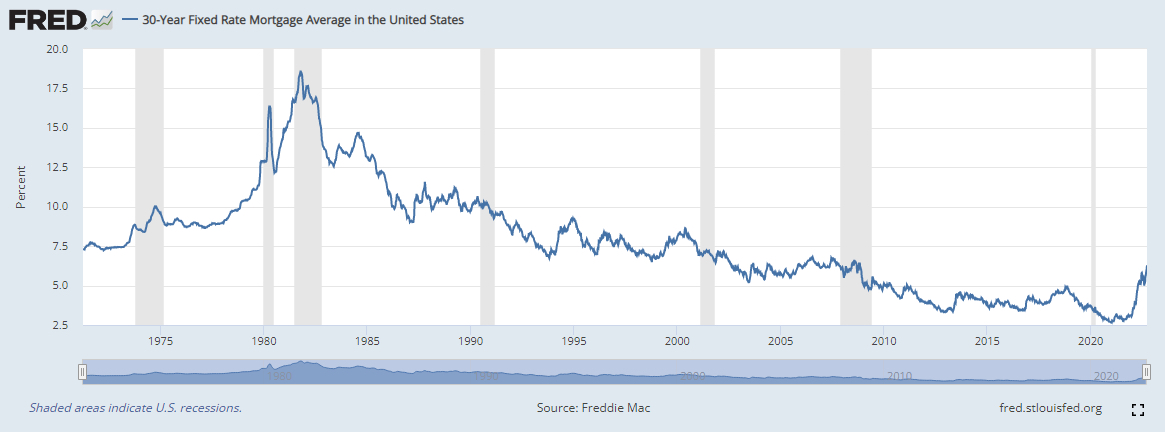

1. We’ve seen interest rates like this before.

Interest rates on mortgages are now above 6% and real estate prices peaked in June. I’m hearing more stories about home purchase deals not closing and buyers getting cold feet.

Looking at the big picture, 6 to 8% mortgage rates are historically normal. I’m not expecting a crash for housing. But prices are going to be stagnant for a while.

(Chart by St. Louis Fed via Jim Lee)

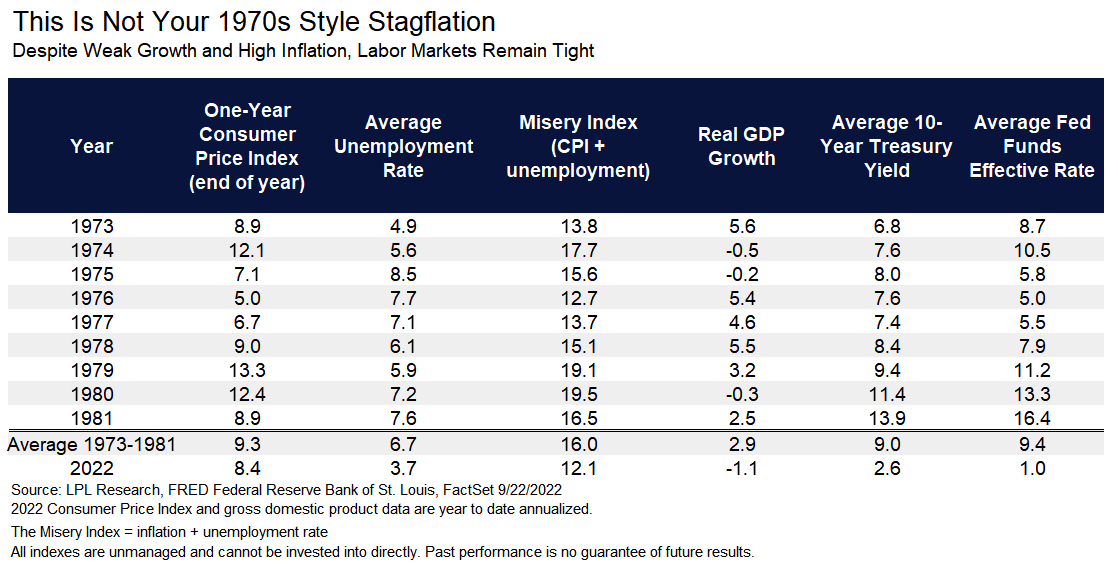

2. History repeats itself, but things are better now.

It feels a lot like the 1970s again. Inflation is back and geopolitical tensions are high.

But were are in a much better place. Unemployment is a mere 3%. In the 1970s it was 6 to 7%. Interest rates were MUCH higher.

(Image via Jim Lee)

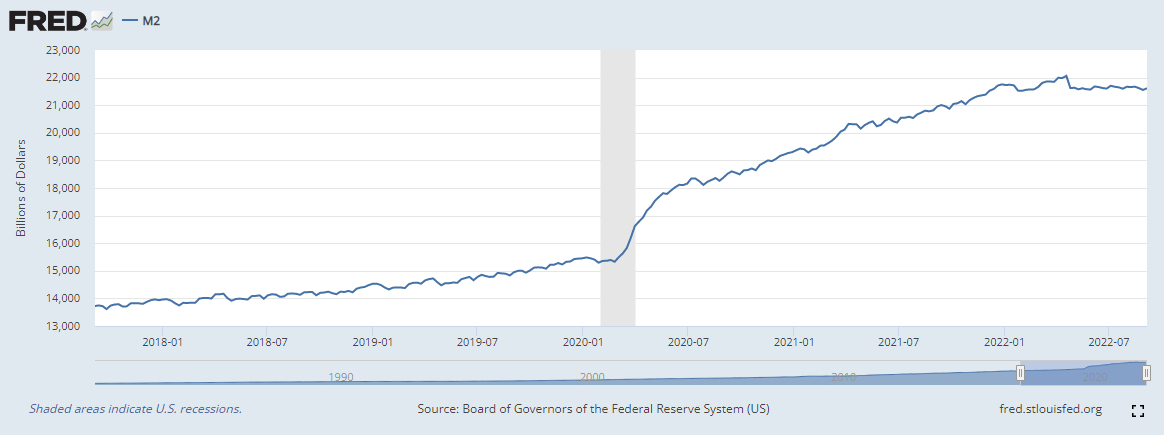

3. The Federal Reserve created this mess; it will clean it up.

We can’t blame inflation on oil prices (which are at the same levels they were a year ago), supply chain issues, or the Russian invasion of Ukraine.

The reason why we have inflation today is because the Federal Reserve and the US government over-stimulated the US economy during COVID. The amount of money in the system is 30% higher since January of 2020. All that cash needed to go somewhere — and it went into higher prices for just about everything.

(Chart by St. Louis Fed via Jim Lee)

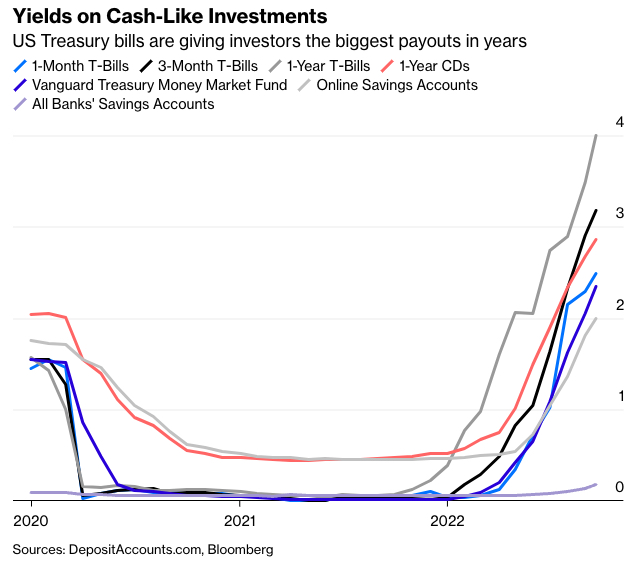

4. Cash yields are getting worthwhile.

Some of the safest investments are finally worth holding. Rates on money market funds, savings accounts, and CDs are all better than they were just three months ago.

These are only a short-term solution as long as inflation remains high.

(Image via Jim Lee)

5. Market worries will pass.

Vanguard recently issued a forecast of 5% annual returns for the stock market over the next 10 years. This is not very exciting, but still much better than what we saw during 2000 to 2010.

When will things get better? We are still in a high-risk period for the market. From a cyclical perspective, my best guess is that stocks may start to stabilize by the end of October. This coming spring, I’d expect things to feel much more “normal” again.

And a little more normal is sounding good right now.

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Delaware daily roundup: Delmarva Power vendor stats; DelDOT's $15M federal grant; 50 best companies to work for

Delaware daily roundup: Over 4,000 Black-owned businesses uncovered; Dover makes rising cities list; a push for online sports betting

Philly daily roundup: East Market coworking; Temple's $2.5M engineering donation; WITS spring summit