A new early-stage fund from Loyola University Maryland is aiming to expand access to capital for BIPOC and women entrepreneurs, and offer investment experience for students.

Launching in the 2022-2023 academic year, the Loyola Angels Fund is an undergraduate program that will include a full year of coursework centered around investment, and provide opportunity for students to spearhead investments in Baltimore businesses. It’s structured as a charitable fund, and has seen plenty of early interest. Since beginning fundraising efforts in the spring, leaders have nearly reached their initial goal of $100,000, and are now raising the target to $250,000, said Wendy Bolger, director of Loyola’s Center for Innovation and Entrepreneurship (CIE).

“The idea is to expose students to the power of an early-stage investment and the opportunity they have to make a real difference for a company,” Bolger said.

A faculty member will be guiding the work, but ultimately students will be evaluating and moving on opportunties.

“They have to do all the work in terms of due diligence, asking questions, figuring out the size of the investment, and they’ll make a recommendation up to the board of the fund,” Bolger said. The initial recommendations are expected in spring 2023.

It’s building for access at a time when the venture capital world is looking to increase diversity among folks writing checks, and those receiving the capital. The initial course will be cross-listed between minors in innovation and entrepreneurship, and African and African American Studies.

Funded in part through a grant from Association of Jesuit Colleges and Universities, five video sessions are being created to focus specifically on the experiences of Black entrepreneurs. A second course for the spring semester will then dig in on due diligence and the process behind angel investment. They’ll also get a chance to meet investors doing this work in town, as additional funds from Loyola’s endowment will also be dedicated to helping students get experience sitting on board meetings of other local angel groups in order to learn how they operate.

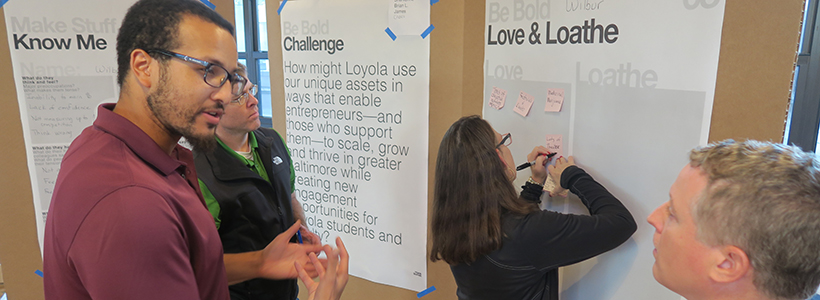

Wendy Bolger. (Courtesy photo)

With specific courses, funding raised by CIE and a faculty role in carrying it all forward, it’s designed as a program that will continue under university leadership, rather than operating on a student-run club model that’s seen at other universities.

With this experience, leaders hope to give students exposure to VC, so they might explore it. With the investments they make while in school, they’ll back entrepreneurs from groups who typically get just a tiny fraction of venture dollars invested each year. Among those who might gain funds are the companies in the CIE’s Baltipreneurs accelerator, which draws from the wider community in Baltimore.

“Access to capital is what the gap is in Baltimore,” Bolger said. “This is designed so it’s just a small drop in the bucket, but this is calling attention to that need and trying to address it in a small way.”

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Baltimore daily roundup: Mayoral candidates talk tech and biz; a guide to greentech vocabulary; a Dutch delegation's visit

Baltimore daily roundup: Medtech made in Baltimore; Sen. Sanders visits Morgan State; Humane Ai review debate

Baltimore daily roundup: An HBCU innovation champion's journey; Sen. Sanders visits Morgan State; Humane Ai review debate