A company’s ability to succeed is increasingly tied to how it uses data to track, measure and analyze how it operates.

That means not only that companies are making more decisions using data, but they’re seeking out as much as they can get. This explosion is all being facilitated by tools that have made that data available in the cloud, as opposed to an on-premises warehouses.

But talk to technologists like Baltimore entrepreneur Gorkem Sevinc, and they’ll tell you there’s an issue underlying all of this: Some of the data that’s behind those decisions is bad. It could be that it was entered wrong, raw data is missing or a system is broken. Whatever the case, it is a tough issue to control as the amount of data being used continues to multiply.

Sevinc experienced this firsthand while serving as technical lead at Baltimore fintech company Facet Wealth. While migrating data from the MVP to a version of the company’s product that was built for scale, he sought out a tool that would automate data quality checks, instead of having to task the team to spend thousands of hours doing it.

“We couldn’t find anything out there in the market that could do that to the specificity that we needed,” Sevinc said. “I ended up rolling up my sleeves and building something with my team.”

At first, he saw it as a “cute little tool.” But as the entrepreneur who was instrumental in starting Facet Wealth, emocha Health and Johns Hopkins Medicine Technology Innovation Center realized the investment in data ecosystems that companies were making, it soon became the source of an idea for a new company. That especially became true when he started talking about the scope of the data quality issue with Daniel Roche, a fellow serial entrepreneur who is also active in Johns Hopkins’ ecosystem.

Market research spoke for itself: Gartner said this was a problem that could result in $15 million a year in losses annually for losses, and IBM estimated it’s a $3 trillion problem. And they saw similarities with a pain point for companies that’s a similarly massive challenge.

“Like cybersecurity, data quality is a huge problem,” said Roche, the company’s chairman and previous founder of Rapid Systems Solutions, Condor Technology Solutions and Relevar. “It’s a problem everyone has, and they either don’t know the extent of their problem, like cyber, or they don’t want to admit they have it.”

Ultimately, the platform Sevinc built was the seed for a new company, and started Qualytics. With a team that increased from two to 14 people since Sevinc left Facet Wealth to start it in March 2020, the company is attracting interest from a notable collection of investors in the B2B and Baltimore tech communities. Its seed round includes investment from Inner Loop Capital, the Maryland Momentum Fund, The LegalTech Fund, TCP Venture Capital, Saas Ventures, Gaingels and angel investors. The Momentum Fund said it made a $250,000 investment, but company is not disclosing the overall size of the round.

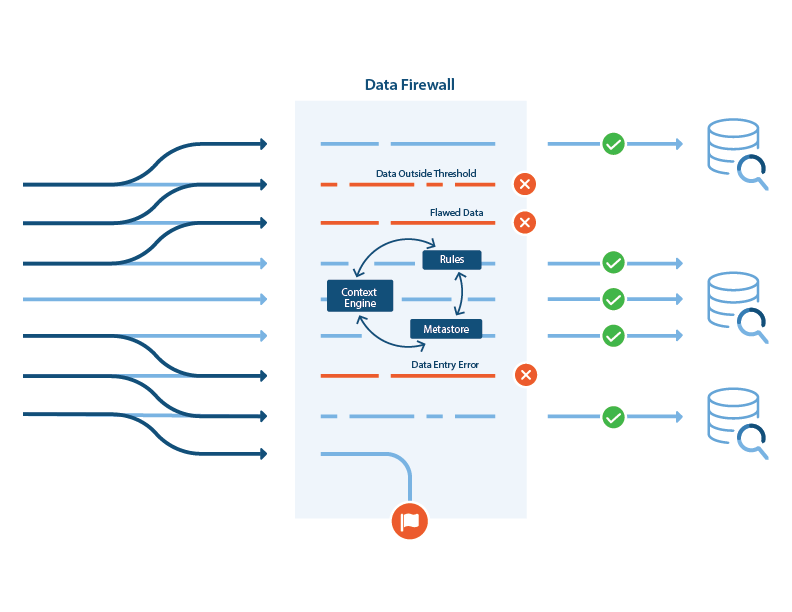

Qualytics’ data firewall, visualized. (Courtesy photo)

At the same time, Qualytics is bringing initial versions of its product to customers. It calls the product a “data firewall.” Like a cyber firewall, the technology sits on top of a company’s systems and looks to detect an anomaly, quarantine the problem and deal with it. But rather than preventing bad attackers from getting into a company’s system, it is targeting the bad data that was entered either through human or machine learning.

Using machine learning and other data technologies, their technology learns from the historic data of a company’s systems, and uses that learning to provide surveillance to catch the bad data as it is flowing through systems. It reviews the data in eight key areas, known as the “Qualytics 8” — data completeness, accuracy, coverage, duplication, consistency, conformity, timeliness and volumetrics. If there’s an issue, that data gets isolated in quarantine, and a human may get involved to review and potentially correct it.

It’s applied in two modes: “Protect” seeks to ensure the integrity of data in general use. A second, called “Compare,” is used in large data migrations from one system to another, like a product upgrade that Sevinc was undergoing when he originally developed the tool at Facet Wealth, or a new data system, like switching from an on-premise Oracle database to a cloud-based database like Snowflake.

The technology is designed to be used “deep in the plumbing” of a company’s systems, as Roche put it. So the users are the data scientists and engineers. It’s designed to be a tool for the folks who may otherwise spend added time combing through data to spot and correct anomalies one by one without such a system.

“The intention is not to replace anybody,” Sevinc said. “The intention is to elevate them to work smarter and have them spend less time handcoding rules to insure data quality.”

In the long run, the idea is that better data flows into warehouses and databases, building confidence in the key indicators that organizations use to draw conclusions from their data, Roche said.

“Qualytics is at the forefront of an extraordinarily large market opportunity with a simple yet elegant solution. People will be saying ‘why didn’t I think of that’ in a few years,” said Chris College, managing partner of Columbia-based TCP Venture Capital, in a statement.

The company is using both modes of the product with early customers, engaging in the feedback loop that helps to improve a system at the early stage. Among a broad set of potential users, the team sees financial services, data brokers and healthcare firms as early adopters.

And while being a company founded during the pandemic means that it started in remote times and hired employees from beyond the city, it has a base at the bwtech@UMBC incubator and plans to build in Baltimore. With cofounders long active in the local tech community, it is digging in with local resources. The company is a member of the Baltimore Tracks coalition seeking to build a diverse tech workforce, it is bringing on interns this summer through the UMBC-administered Maryland Technology Internship Program and the recently launched Johns Hopkins Internship Network in the Mathematical Sciences, called INMAS.

“It’s not just get, it’s also give to the Baltimore community, as well,” Sevinc said. “We take that very seriously.”

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Baltimore daily roundup: The city's new esports lab; a conference in Wilmington; GBC reports $4B of economic activity

Baltimore daily roundup: Find your next coworking space; sea turtle legislation; Dali raided and sued

Baltimore daily roundup: Johns Hopkins dedicates The Pava Center; Q1's VC outlook; Cal Ripken inaugurates youth STEM center