The Maryland General Assembly ended its 2013 legislative session April 8.

One of the measures approved this year was the Cybersecurity Investment Incentive Tax Credit.

MDBizNews offers a breakdown of what the tax credit provides:

- Establishes a tax credit for investment in startup cybersecurity companies that will help solidify Maryland’s place as a cybersecurity leader in both the government and commercial spaces

- Provides a refundable tax credit to qualified Maryland cybersecurity companies that seek and secure capital from an in-state or out-of-state investor

- Funds the tax credit at $3 million for fiscal year 2014

- Allows Maryland to promote the development of startup cybersecurity companies that provide greater revenues for the state

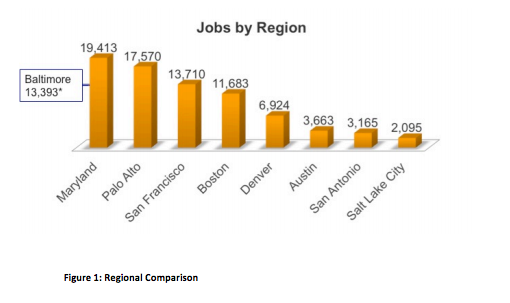

Technically Baltimore has reported much on Maryland’s cybersecurity sector, which is made up of roughly 20,000 jobs, 13,000 of those in Baltimore city.

This tax credit is yet another step in Governor Martin O’Malley‘s push to make the state the “epicenter of cybersecurity.”

Join the conversation!

Find news, events, jobs and people who share your interests on Technical.ly's open community Slack

Baltimore daily roundup: The city's new esports lab; a conference in Wilmington; GBC reports $4B of economic activity

Baltimore daily roundup: Find your next coworking space; sea turtle legislation; Dali raided and sued

Baltimore daily roundup: Johns Hopkins dedicates The Pava Center; Q1's VC outlook; Cal Ripken inaugurates youth STEM center